Prosthetic Insurance Coverage: Understanding Your Options

Prosthetic insurance coverage varies depending on the specific plan and insurance company. In general, coverage may include both the prosthetic device itself and any necessary services related to its fitting and adjustment.

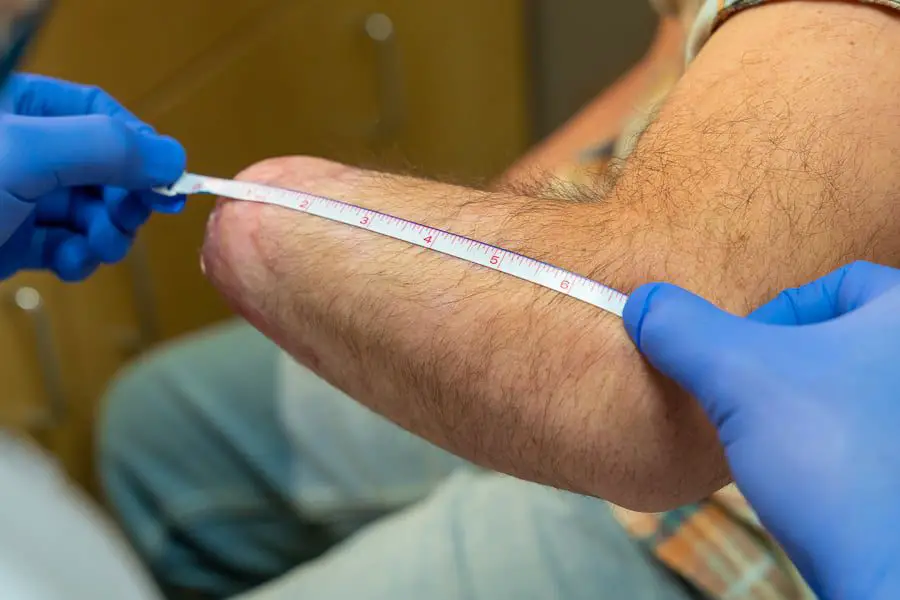

Prosthetic devices can help individuals who have lost limbs or suffered from congenital limb abnormalities to regain mobility and independence. However, the cost of these devices and associated services can be prohibitively expensive. That’s where insurance coverage can make a big difference. Depending on the specifics of the policy, it may cover the device itself, as well as any necessary services such as consultation and fitting appointments. It’s important to carefully review insurance options to ensure adequate coverage and communicate with healthcare providers to determine necessary devices and services.

Credit: www.dukehealth.org

Types Of Prosthetic Insurance Coverage

Prosthetic Insurance Coverage

Losing a limb can lead to many challenges, including finding the right prosthetic device and making sure that you have sufficient insurance coverage. Fortunately, there are several types of prosthetic insurance coverage options available that can help you manage these challenges.

In this post, we will explore some of the most common types of prosthetic insurance coverage, including employer-sponsored plans, private health insurance, medicaid, medicare, and va benefits.

Employer-Sponsored Plans

If you are employed, you may have access to an employer-sponsored insurance plan. These plans typically cover prosthetic devices, although the amount of coverage can vary depending on the plan.

- Employer-sponsored plans are required to cover prosthetic devices under the affordable care act.

- However, coverage amounts can vary depending on the plan and the state where you live.

- Some employer-sponsored plans may require pre-authorization before covering a prosthetic device.

Private Health Insurance

Private health insurance is another option for prosthetic insurance coverage. Many private insurers cover prosthetic devices, although again, the amount of coverage can vary from plan to plan.

- Private health insurance plans are required to cover prosthetic devices under the affordable care act.

- However, some insurance plans may have a cap on the amount of coverage provided.

- Pre-authorization may be required before insurance will cover a prosthetic device.

Medicaid

Medicaid is a state-run health insurance program that is available to people with low incomes. Each state has its own set of rules and coverage limits, but medicaid may cover some or all of the cost of a prosthetic device.

- Medicaid is required to cover prosthetic devices under the affordable care act.

- However, the amount of coverage provided can vary depending on the state where you live.

- In some states, prior approval is required before medicaid will cover the cost of a prosthetic device.

Medicare

Medicare is a federal health insurance program that is available to people who are 65 years old or older, people with certain disabilities, and people with end-stage renal disease. Medicare typically covers the cost of prosthetic devices, although the amount of coverage can vary.

- Medicare is required to cover prosthetic devices under federal law.

- However, you may be responsible for a portion of the cost of the device.

- Some prosthetic devices may require pre-approval before medicare will cover the cost.

Va Benefits

If you are a veteran, you may be eligible for prosthetic insurance coverage through the department of veterans affairs. The va provides a wide range of benefits to veterans, including coverage for prosthetic devices.

- Veterans are eligible for prosthetic devices if they have a service-connected disability that requires a device.

- The va will cover the full cost of the device and any necessary repairs.

- Veterans can receive ongoing care and maintenance for their prosthetic device through the va.

Overall, there are several options available for prosthetic insurance coverage, including employer-sponsored plans, private health insurance, medicaid, medicare, and va benefits. If you need a prosthetic device, be sure to explore all of your insurance coverage options to find the one that is right for you.

Factors To Consider When Choosing A Prosthetic Insurance Plan

Prosthetic insurance coverage – factors to consider when choosing a prosthetic insurance plan

Facing limb loss can be overwhelming and stressful, both emotionally and financially. That’s why having a comprehensive prosthetic insurance plan is essential. However, not all insurance plans are created equal, and you need to consider several crucial factors when selecting the right one for you.

Cost

When it comes to prosthetic insurance plans, cost is one of the most critical factors to consider. The total cost of your prosthetic device is determined by several factors, including its type, materials used, and maintenance or replacement costs. Some insurance plans cover the total cost of prosthetic devices, while others have a limit on the amount they will cover.

Furthermore, some insurance plans require co-pays, which can add up quickly.

- Annual deductibles, co-insurance, and out-of-pocket limits

- Premiums, including monthly, quarterly, and annual payments

- Check whether pre-approval is necessary for the initial consultation and diagnostic tests

- Understand the extent of coverage for prosthetics such as liners, sockets, and other components

- Know what the policy covers, such as maintenance, repair, and replacement of prosthetics

Coverage Limitations

As you evaluate different prosthetic insurance plans, make sure you examine the limitations of the coverage each plan offers. Look closely at the fine print of each policy, as this will help you identify any coverage limitations.

- Determine what prosthetic devices are covered

- Find out how often the devices will be replaced

- Learn whether there are preferred providers, and if you need pre-approval to visit them

- Clarify whether the policy has any exclusions, such as a particular age group or type of prosthesis

Provider Network

When you are choosing a prosthetic insurance plan, another significant factor to consider is the provider network. To prevent unnecessary expenses, you must choose an insurance plan with doctors and specialists who have experience in prosthetic care.

- How many specialists are in the network who have experience fitting prosthetics?

- Are you free to choose a provider or do you get assigned one?

- Does the provider have experience fitting prosthetics for your specific type of limb loss?

Quality Of Coverage

It’s essential to consider the quality of prosthetic coverage that each insurance plan offers. You must have a comprehensive plan that not only covers the cost of the device but also provides ongoing maintenance, repair, and replacements.

- Clarify the extent of coverage for prosthetic components and repairs

- Find out if the policy allows for upgrades and improvements to the prosthesis

- Check if the policy covers physical therapy or rehabilitation services

- Determine if the policy will cover the cost of a new prosthesis as technology advances.

Understanding the factors to consider when selecting a prosthetic insurance plan plays a significant role in providing you with peace of mind and financial security. Consider the factors we’ve discussed, such as cost, coverage limitations, provider network, and quality of coverage, to ensure that you choose a plan that meets all your needs and provides comprehensive prosthetic care.

How To Get Your Prosthetic Device Covered By Insurance

Understanding The Claims Process For Prosthetic Insurance Coverage

Prosthetic insurance coverage is essential for anyone looking to get a prosthetic limb. However, navigating the claims process can be complex and intimidating. That’s why understanding the procedures involved in prosthetic insurance coverage can make the experience much easier. In this article, we’ll examine how to submit claims for prosthetic insurance coverage and the most common reasons for denied claims.

How To Submit A Claim

Submitting claims for prosthetic insurance coverage is a multi-step process.

- gather required documents – before starting the claims process, you’ll need to gather key documents such as your insurance policy, physician’s assessment, and prosthetist’s recommendation. Make sure to have a complete understanding of your coverage and payment requirements.

- contact your insurer – contact your insurer’s customer service department to get detailed information about how to file a claim. Learn about their standards and requirements for filing a claim.

- fill out the forms – your insurer will provide you with all the necessary forms to submit a claim. Make sure that you fill them out correctly and that all information is accurate. Include all required documents, such as receipts, invoices, and itemized bills.

- submit the claim – once you have submitted the claim, it’s essential to track its progress. Contact your insurer’s customer service department to check the status of your claim regularly.

Common Reasons For Denied Claims

Even if you follow all the necessary steps to submit your claim, your insurer may still deny coverage.

- lack of medical necessity – if the insurer’s medical director determines that the procedure or device is not medically necessary, then the claim will be denied.

- out-of-network provider – most insurance plans have a network of providers with whom the policyholders can receive care. If you go to an out-of-network provider, there’s a good chance that your claim will be denied.

- missing or inaccurate information – incorrect documentation and inaccurate information can lead to claim denials. Make sure to double-check all forms before submitting your claim to avoid this.

- lapsed coverage – if your policy has lapsed, or you haven’t paid your premiums, your claim will be denied.

Submitting a claim for prosthetic insurance coverage is a necessary but complicated process. To avoid being denied coverage, make sure you follow all the necessary steps and guidelines for filing a claim. Understanding the common reasons for denied claims can help you take the necessary steps to ensure coverage.

Frequently Asked Questions About Prosthetic Insurance Coverage

Prosthetic Insurance Coverage: Frequently Asked Questions

For those who require a prosthetic, having insurance coverage can make a significant financial impact. However, navigating prosthetic insurance coverage can be confusing, and there are many common questions that individuals have.

How Much Will Insurance Cover For My Prosthetic?

Under the affordable care act, insurance providers are required to cover prosthetics as an essential health benefit. However, the amount of coverage can vary depending on your specific plan. It is essential to review your insurance policy, as it will outline the details of your prosthetic coverage.

Some insurance plans may cover 80% of the cost, while others may only cover 30%.

Do I Need Pre-Authorization For My Prosthetic?

Many insurance plans require pre-authorization before covering a prosthetic. This means that individuals must receive approval from their insurance provider before receiving the prosthetic. You can typically find the pre-authorization process outlined in your insurance policy. Failure to obtain pre-authorization may result in a denial of coverage.

What If I Have Multiple Prosthetics?

If you require multiple prosthetics, insurance coverage will vary depending on your policy. Some insurance plans may consider multiple prosthetics medically necessary and provide full coverage. Others may require individuals to pay a percentage of the cost. It is essential to review your policy to determine coverage.

How Often Can I Get Replacements For My Prosthetic?

Prosthetics wear out over time and require replacement. Insurance coverage for prosthetic replacements varies depending on the policy. Some policies will cover replacements on a certain schedule, while others will require pre-authorization for each replacement. It is essential to review your policy to determine the specifics of prosthetic replacement coverage.

Can I Get Coverage For My Prosthetic If It’S For A Sports Or Recreational Activity?

Individuals who require prosthetics for recreational activities, such as sports, may still be eligible for coverage. However, coverage will depend on the policy. Some policies may have exclusions for coverage for prosthetics used in recreational activities. It is essential to review your policy to determine coverage.

Understanding prosthetic insurance coverage can be overwhelming. However, by reviewing your policy, understanding pre-authorization, and speaking with your provider, you can ensure you receive the coverage you need.

Finding Resources And Support For Prosthetic Insurance Coverage

Prosthetic Insurance Coverage: Finding Resources And Support

Losing a limb is a difficult experience that can take a significant toll on your physical, emotional, and financial well-being. Thankfully, prosthetic devices can help amputees regain their independence and lead fulfilling lives. However, prosthetics can be costly, and it’s crucial to have comprehensive insurance coverage to pay for them.

If you or your loved one has recently undergone an amputation, finding resources and support for prosthetic insurance coverage can help you navigate the complex insurance landscape. Here are some of the key resources and support systems available to you.

Independent Advocacy Organizations

Independent advocacy organizations can be a great resource for amputees and their families. These non-profit organizations work to represent the interests of amputees and provide support and resources to help them navigate the healthcare system.

- Providing guidance on how to communicate with insurance companies and advocate for coverage

- Offering advice on finding the most affordable prosthetic devices that meet your needs

- Helping you navigate insurance appeals if coverage is denied

- Providing emotional support and community resources to help you cope with the challenges of limb loss.

Peer Support Groups

Peer support groups can be a valuable source of information and emotional support, especially if you or your loved one is coping with the loss of a limb. These groups can help you connect with others who have gone through similar experiences and can provide practical advice on navigating the healthcare system.

- Sharing strategies for communicating with insurance companies and advocating for coverage

- Providing advice on the most affordable prosthetic devices that meet your needs

- Offering emotional support and community resources to help you cope with the challenges of limb loss.

Government Resources

Several government resources are available to help amputees obtain prosthetic insurance coverage.

- Medicare: medicare is a federal health insurance program primarily for people who are 65 or older and also covers people with disabilities. It covers both upper and lower limb prostheses.

- Medicaid: medicaid is a joint federal and state program that provides healthcare coverage for people with low income. Each state has its own medicaid program, and coverage for prosthetic devices may vary.

- Department of veterans affairs: the department of veterans affairs provides several benefits to veterans with disabilities, including prosthetic devices. Veterans with service-connected disabilities can receive free prosthetic devices through the va.

Securing comprehensive insurance coverage for prosthetic devices is essential for amputees to regain their independence and lead fulfilling lives. Independent advocacy organizations, peer support groups, and government resources can provide valuable support and guidance in navigating the complex insurance landscape.

By taking advantage of these resources, amputees and their families can make informed decisions about their healthcare needs.

Frequently Asked Questions For Prosthetic Insurance Coverage

What Is Prosthetic Insurance Coverage?

Prosthetic insurance coverage is a type of health insurance policy that helps cover the cost of prosthetic devices. This coverage can be provided by private health insurance companies, medicare, or medicaid. It typically includes a range of prosthetic devices, including artificial limbs, braces, and other support devices.

The specifics of what is covered by a prosthetic insurance policy can vary depending on the plan.

What Types Of Prosthetic Devices Are Typically Covered By Insurance?

Insurance typically covers all types of prosthetic devices that are medically necessary, including arms, legs, hands, feet, and fingers. Insurance companies may require prior authorization or proof of medical necessity. Some policies may also cover maintenance and replacement of the prosthetic device.

Do All Insurance Plans Cover Prosthetic Devices?

Not all insurance plans cover prosthetic devices. However, many provide coverage for the cost of prosthetic devices and related services. It is important to check with your insurance provider to determine what prosthetic device coverage is available under your policy.

Can Insurance Coverage For Prosthetics Be Limited Or Denied?

Yes, insurance coverage for prosthetics can be limited or denied. Insurance companies may impose coverage limits or exclusions based on medical necessity, cost, or other factors. It is essential to review your policy details carefully and discuss any coverage concerns with your healthcare provider or insurance company.

How Can I Ensure That My Prosthetic Device Will Be Covered By Insurance?

To ensure insurance coverage for your prosthetic device, you must check your policy, verify your eligibility, obtain necessary documentation, and follow proper procedures. Work closely with your insurance provider, healthcare professional, and prosthetist to ensure your best chances of approval.

What Is The Process For Obtaining Insurance Coverage For A Prosthetic Device?

To obtain insurance coverage for a prosthetic device, you need to check your insurance plan for specific coverage options. You may also need a doctor’s recommendation, prior authorization, and documentation of medical necessity. Be prepared to work with your insurance company and provide any necessary information for approval.

How Much Will Insurance Cover For My Prosthetic Device?

The amount of insurance coverage for a prosthetic device varies based on the type of policy and state you live in. Some states have laws that require insurers to cover a certain percentage or dollar amount for prosthetics. Check your policy and state laws to determine your coverage.

Are There Any Alternative Options For Financing A Prosthetic Device If Insurance Coverage Is Limited Or Denied?

Yes, there are alternative options for financing a prosthetic device if insurance coverage is limited or denied. Some options include applying for grants, crowdfunding, and seeking assistance from non-profit organizations. Patients can also negotiate payment plans with their healthcare provider or explore personal loan options.

Conclusion

In today’s world, quality healthcare is essential for everyone. Insurance coverage for prosthetics is a crucial consideration for people who require these devices to live life to the fullest. With the market full of different insurance policies, it is important to understand the coverage details, including deductibles, co-payments, and limits.

As we have discussed in this article, not all insurance policies cover prosthetics. Therefore, it is hugely important to research beforehand and verify the coverage from your insurer. Although the process may seem cumbersome, knowing the right insurance coverage can ease a significant burden off the shoulders of an individual.

It is important to take advantage of all of the resources available when deciding on the right coverage. Correctly chosen insurance coverage, can safeguard your peace of mind by providing potential assistance in the future.