For QuickBooks W2, go to Taxes, then Payroll tax, and select Filings in QuickBooks to access W2 forms and resources. QuickBooks provides a streamlined and efficient process for managing tax filings and W2 forms.

With QuickBooks, you can easily access and print both employer and employee copies of W2 forms in just a few simple steps, making payroll management hassle-free. Integrating QuickBooks into your business operations can significantly streamline your payroll tax processes and ensure compliance with tax regulations.

The user-friendly interface and comprehensive resources available within QuickBooks make it a valuable tool for efficiently managing W2 forms and other payroll-related tasks. By utilizing QuickBooks for W2 processing, businesses can simplify their tax filing procedures and enhance overall financial management.

Quickbooks W-2 Features

Quickbooks W-2 features streamline the process of generating and printing employer and employee copies efficiently. The tool enhances user experience by providing easy access to vital payroll information. With Quickbooks W-2, managing tax filings becomes seamless and hassle-free.

Quickbooks offers a range of features when it comes to processing and managing W-2 forms. These features are designed to simplify the process and ensure accurate filing for both employers and employees. Here are the key features that Quickbooks provides:

Electronic W-2 Filing

With Quickbooks, you can easily file W-2 forms electronically, saving you time and effort. This feature eliminates the need for manual paper filing, reducing the risk of errors and speeding up the filing process. By electronically filing your W-2 forms, you can ensure their timely submission to the relevant tax authorities.

Employee Copies Printing

Quickbooks allows you to print employee copies of W-2 forms with ease. This feature is especially convenient for distributing physical copies to your employees. With just a few clicks, you can generate and print accurate W-2 forms for your employees, ensuring that they receive the necessary documents for their tax filing.

In conclusion, Quickbooks provides seamless and efficient W-2 features, such as electronic filing and employee copies printing. These features streamline the W-2 process for employers and employees alike, ensuring accurate and timely filing of tax forms.

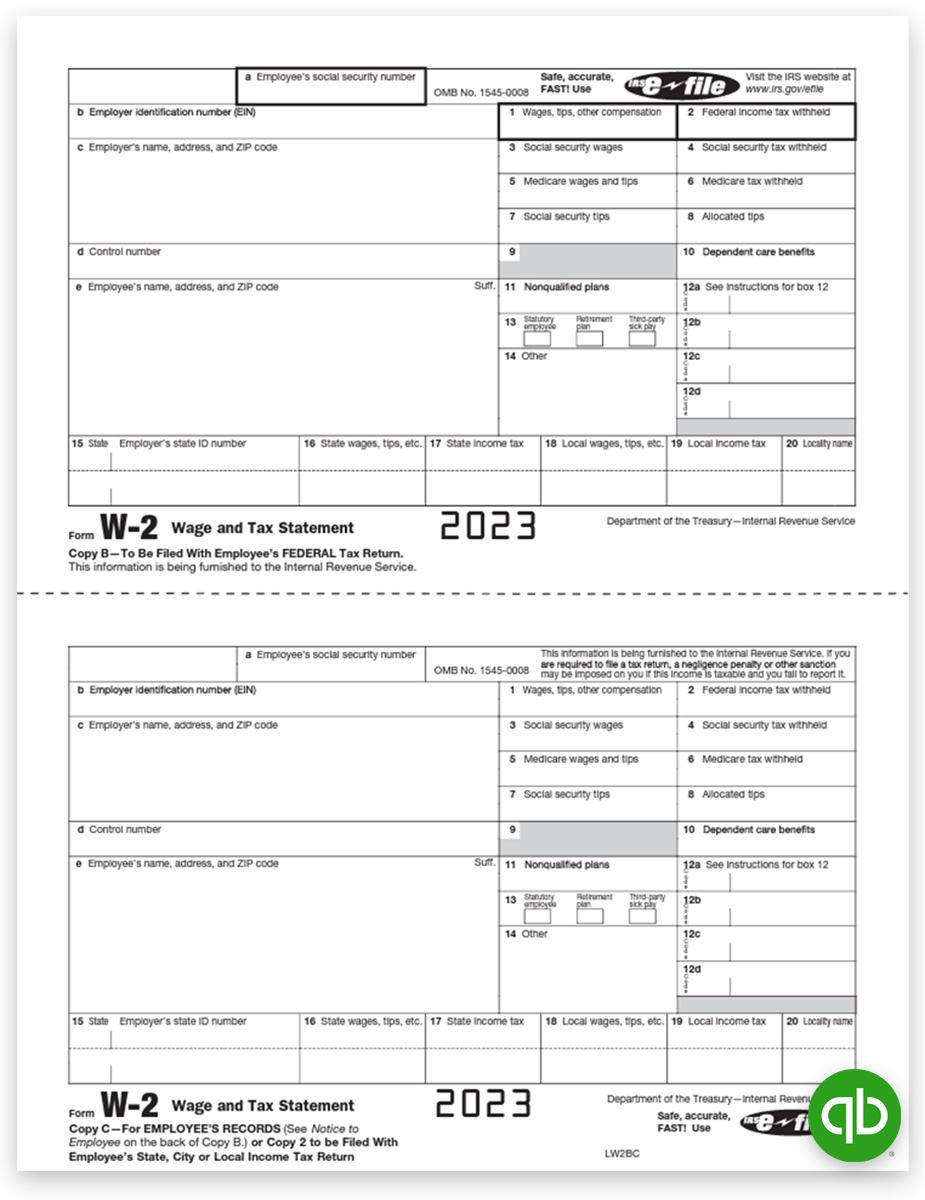

Credit: www.discounttaxforms.com

Quickbooks W-2 Process

Quickbooks makes it easy for businesses to generate and print W-2 forms for their employees. The W-2 form is a crucial tax document that reports the annual wages and the amount of taxes withheld from an employee’s paycheck. With Quickbooks, employers can access W-2 forms, print employer and employee copies, and ensure compliance with tax regulations.

Accessing W-2 In Quickbooks

To access W-2 forms in Quickbooks, users can follow these simple steps:

- Login to your Quickbooks account

- Navigate to the Payroll tab

- Select the W-2 forms option

- Choose the desired tax year for the W-2 forms

Printing Employer And Employee Copies

After accessing the W-2 forms, employers can easily print both employer and employee copies to distribute. Printing the W-2 forms from Quickbooks involves:

- Selecting the desired employee’s W-2 form

- Clicking on the print option

- Choosing the print settings and preferences

- Confirming the print action to generate hard copies

Integration With Other Platforms

QuickBooks W2 offers seamless integration with various platforms, allowing businesses to streamline their operations and manage payroll more efficiently. The integration with other software systems enhances the overall capabilities of QuickBooks W2, providing users with a comprehensive solution for their accounting and payroll needs.

Netsuite Integration

NetSuite integration with QuickBooks W2 provides businesses with a unified platform for managing financial and HR tasks. By integrating NetSuite with QuickBooks W2, users can synchronize employee data, payroll information, and financial transactions, ensuring accurate and up-to-date reporting across both systems. This integration streamlines the process of reconciling data, eliminating the need for manual entry and reducing the likelihood of errors.

Quickbooks Online Payroll Integration

Integrating QuickBooks W2 with QuickBooks Online Payroll offers a seamless solution for managing payroll and tax filings. The integration allows users to sync employee information, wage data, and tax calculations between QuickBooks W2 and QuickBooks Online Payroll, simplifying the payroll process and ensuring compliance with tax regulations. This seamless integration enhances the efficiency and accuracy of payroll management, enabling businesses to focus on strategic growth initiatives.

Credit: quickbooks.intuit.com

Community Support And Resources

As a Quickbooks user, it’s essential to have access to a strong community support and reliable resources. Quickbooks understands this need and provides various avenues for users to seek help, ask questions, and connect with other users facing similar challenges. Whether you need assistance with accessing Quickbooks Community or getting help and answers to your queries, Quickbooks has you covered. Let’s explore these options below.

Accessing Quickbooks Community

If you’re looking for a place to connect with fellow Quickbooks users and experts, the Quickbooks Community is the ideal platform. Here you can ask questions, share your knowledge, and get valuable insights from experienced users. Accessing the community is straightforward. Follow these steps:

- Visit the Quickbooks website at https://quickbooks.intuit.com/.

- Sign in or sign up to create an account if you don’t have one already.

- Once logged in, navigate to the forum section to start interacting with the community.

Getting Help And Answers

Quickbooks provides multiple resources to help you find answers to your queries. Here’s how you can efficiently seek help:

- Visit the Quickbooks Help Center for detailed articles and guides: https://quickbooks.intuit.com/learn-support/articles.

- Explore the Frequently Asked Questions (FAQs) section for quick answers to common queries.

- Use the search function to find specific topics or keywords relevant to your query.

- Consider joining webinars and live tutorials organized by Quickbooks to gain a deeper understanding of the software.

Remember, Quickbooks aims to support its users in every possible way, so don’t hesitate to reach out and make the most of these resources. Happy accounting!

Credit: quickbooks.intuit.com

Frequently Asked Questions On Quickbooks W2

How Do I Get My W-2 From Quickbooks?

To get your W-2 from QuickBooks, log in to your account, go to Taxes, select Payroll tax, then Filings and Resources, choose W-2.

Does Quickbooks Automatically Send W-2?

No, QuickBooks does not automatically send W-2 forms. However, you can generate and print W-2 forms using the QuickBooks software.

How Do I Get My W-2 From Quickbooks Workforce?

To get your W-2 from QuickBooks Workforce, go to the Documents menu and select Print. Choose the W-2 form, then print or download it as needed.

Which W-2 Forms Work With Quickbooks?

QuickBooks works with all standard W-2 forms for employee wage and tax statements.

Conclusion

Quickbooks W2 is an essential tool for streamline payroll processes and ensuring accurate record-keeping. With Quickbooks Workforce, employers can easily print employer and employee copies of W2 forms, making the tax filing process efficient and hassle-free. By utilizing Quickbooks’ user-friendly interface and comprehensive resources, businesses can save time and minimize errors.

Join the large community of Quickbooks users and unlock the full potential of this powerful accounting software. Stay organized, compliant, and in control with Quickbooks W2.