To merge vendors in Quickbooks, go to “Expenses,” then select “Vendors,” find and open the vendor profile you want to keep, and note the Company name and details. Then, you can merge duplicate vendors.

Streamlining vendor profiles is a crucial administrative task in Quickbooks, ensuring accuracy and efficiency in accounting processes. By merging duplicate or similar vendor entries, businesses can avoid confusion and errors in financial records, simplifying expense management. Quickbooks provides a user-friendly process to merge vendors with the same or similar names, allowing for seamless integration of data and improved organizational coherence.

Simplifying vendor lists can enhance overall bookkeeping operations and facilitate accurate financial reporting. This article aims to provide a comprehensive guide on merging vendors in Quickbooks, offering valuable insights into optimizing vendor management within the platform.

Credit: canduskampfer.com

The Importance Of Merging Vendors

Merge Vendors in QuickBooks is paramount for streamlined financial management. Combining vendor entries enhances accuracy and simplifies tracking transactions efficiently. Optimize your QuickBooks system by merging vendors with similar or same names to boost productivity.

Vendors play a crucial role in any business, as they supply goods or services that are essential for smooth operations. However, as a business grows, it is common to have multiple vendors for various reasons. While having multiple vendors may seem manageable initially, it can quickly become a challenge to keep track of payments, manage contacts, and monitor expenses.

When it comes to managing vendor data efficiently, merging vendors in QuickBooks can be a game-changer. By merging vendors with similar or duplicate names, you can consolidate your vendor information into a single record, making it easier to analyze and track your vendor-related activities. This not only saves you time and effort but also helps in maintaining accurate vendor records and reducing the risk of errors.

Avoiding Confusion In Vendor Records

Avoiding confusion in vendor records is another crucial aspect of merging vendors in QuickBooks. Having duplicate or similar vendor names can lead to confusion when creating transactions or generating reports. For example, you may accidentally make payments to the wrong vendor or duplicate expenses.

Merging vendors allows you to eliminate these duplicate or similar records, ensuring that you have a clear and organized list of vendors. It simplifies the process of selecting vendors while creating transactions, making it less prone to errors. Additionally, when generating reports, you can trust that the data is accurate and reflects the true financial status of your business.

In conclusion, merging vendors in QuickBooks is integral to managing vendor data efficiently and avoiding confusion in vendor records. It helps streamline your vendor management process, improves accuracy, and saves valuable time. By consolidating vendor information, you can better track payments, monitor expenses, and maintain accurate records, ultimately contributing to the overall success of your business.

Methods Of Merging Vendors

When managing your vendor list in QuickBooks, you may encounter duplicate entries that can clutter your records and lead to confusion when tracking transactions. To streamline your vendor management, QuickBooks provides methods to merge vendors with ease and efficiency.

Procedure In Quickbooks Desktop

Merging vendors in QuickBooks Desktop is a straightforward process. Follow these steps to combine duplicate vendor entries:

- Access the Vendor Center in QuickBooks Desktop by clicking on the “Vendors” menu.

- Select “Vendor Center” to open the list of vendors.

- Identify the duplicate vendors that you want to merge.

- Right-click on the duplicate vendor and choose “Edit Vendor” from the dropdown menu.

- You can then modify the vendor’s name to match the primary vendor’s name, ensuring the information is consistent across all transactions and records.

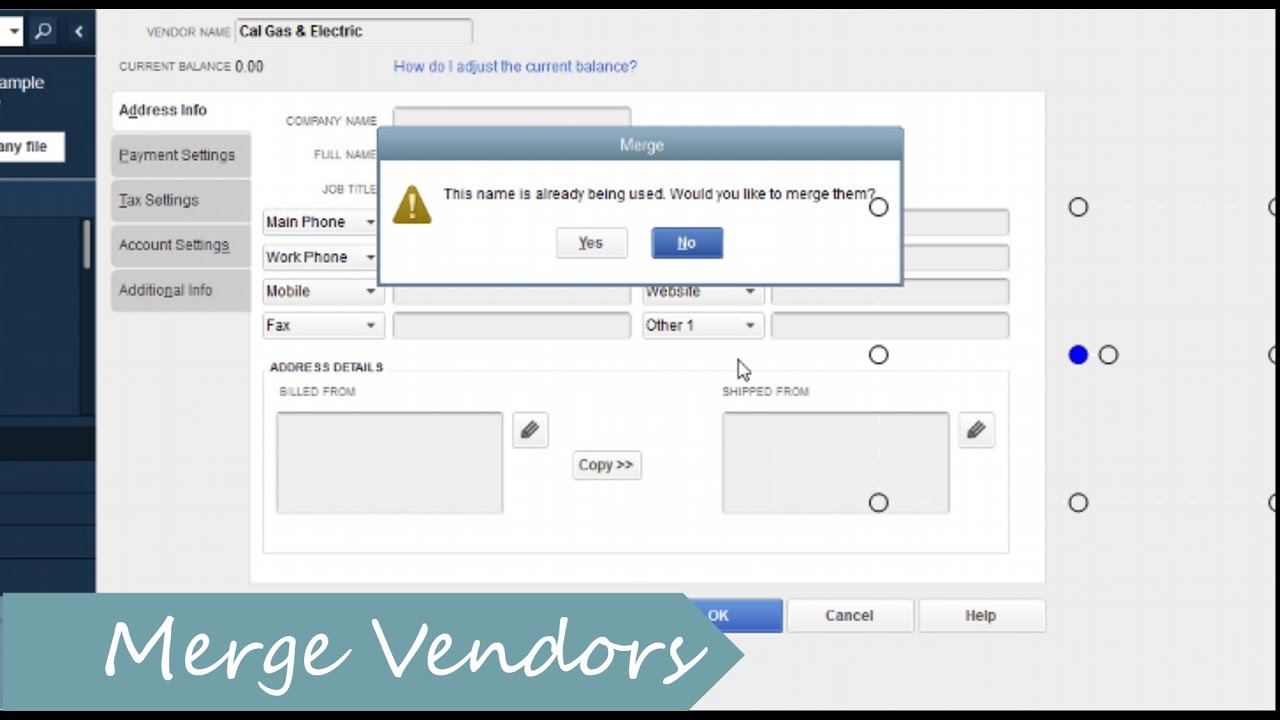

- After editing the duplicate vendor’s name, QuickBooks will prompt you to merge the two vendors. Confirm the merge to combine the vendor profiles into one cohesive entry.

Step-by-step Guide For Quickbooks Online

For users of QuickBooks Online, merging vendors is a seamless process that helps maintain an organized vendor list. Follow these step-by-step instructions to merge vendors in QuickBooks Online:

- Navigate to the “Expenses” or “Suppliers” tab in QuickBooks Online.

- Locate the vendors you wish to merge within the list.

- Click on the vendor you want to retain as the primary entry.

- Find and select the option to merge the vendor with another entry.

- Choose the duplicate vendor that you want to merge with the primary vendor.

- Confirm the merge action to consolidate the vendor records.

Benefits Of Merging Vendors

When managing vendor lists in QuickBooks, you may encounter duplicate or similar entries that can clutter your records. One way to address this issue is by utilizing the Merge Vendors feature. This functionality allows you to combine multiple vendor entries into a single, unified record, streamlining your vendor management process. Let’s explore the specific benefits of merging vendors in QuickBooks.

Maintaining Clean And Accurate Records

By merging vendors with similar or duplicate details, you can ensure that your vendor list remains organized and free of redundant entries. This consolidation helps in maintaining clean and accurate records by eliminating the confusion that may arise from having multiple entries for the same vendor. It also prevents errors and discrepancies in your financial data, promoting a more efficient bookkeeping process.

Simplified Reporting And Analysis

When vendors are merged, it simplifies the reporting and analysis process in QuickBooks. With fewer vendor entries to navigate, generating reports and conducting analyses becomes more straightforward. This streamlining effect can save time and effort, allowing you to focus on extracting meaningful insights from your vendor-related data without being encumbered by unnecessary complexity.

Credit: quickbooks.intuit.com

Issues To Consider Before Merging

Before merging vendors in Quickbooks, there are important issues to consider. Make sure to review and update vendor information, check for duplicate entries, and carefully select a primary vendor for merging. This will ensure a smooth and accurate consolidation of vendor data in Quickbooks.

Backup And Data Integrity

Before merging vendors in Quickbooks, it is crucial to ensure that you have a proper backup of your data. Backing up your data is essential to prevent any potential loss or corruption during the merging process. Having a backup allows you to restore your previous vendor data in case anything goes wrong during the merge.

Additionally, you need to verify the integrity of your data before merging vendors. Make sure that all the information associated with each vendor is accurate and up-to-date. This involves checking contact details, addresses, transactions, and any custom fields that you have created.

Potential Impacts On Financial Statements

Merging vendors can have potential impacts on your financial statements, so it is important to consider these before proceeding. Make sure to review your financial statements, including your balance sheet and income statement, to identify any potential issues that may arise due to merging.

One aspect to carefully consider is the impact on open transactions. If you have any outstanding bills or payments with the vendors you plan to merge, these transactions need to be resolved before proceeding. Failure to do so may lead to inaccuracies in your financial statements.

Moreover, merging vendors can also affect your purchase history and reports. Take the time to review your reports, such as your purchase history and vendor payment summary, to ensure that the merged vendors do not disrupt your records. It is essential to maintain accurate and consistent reporting for proper financial analysis.

Best Practices For Merging Vendors

For seamless vendor management in QuickBooks, follow the best practices for merging vendors. Use the “Merge Vendors” tool in the Accountant and Enterprise editions, select the vendors to merge, and designate a primary vendor to merge. This ensures accurate and efficient vendor consolidation within QuickBooks.

Regularly Reviewing Vendor Lists

Review vendor lists periodically. Clean outdated or duplicate entries to maintain accuracy.

Seeking Professional Assistance When Needed

Consider professional help for complex merges. Experts ensure seamless vendor consolidation.

Credit: quickbooks.intuit.com

Frequently Asked Questions Of Merge Vendors In Quickbooks

Is There A Way To Merge Vendors In Quickbooks?

Yes, you can merge vendors in QuickBooks by using the “Merge Vendors” tool in Accountant and Enterprise editions. Simply go to the Accountant menu, select Client Data Review, then merge the vendors you want. Choose a primary vendor, merge, and confirm.

Can I Merge Companies In Quickbooks?

No, you cannot merge companies in QuickBooks. Each company is created as a separate file and cannot be combined. However, you can manually enter the data from one company into another if needed.

Which 2 Accounts Cannot Be Merged In Quickbooks Online?

You cannot merge accounts connected to online banking or accounts with reconciliation history in QuickBooks Online.

Can You Merge Items In Quickbooks?

Yes, you can merge items in QuickBooks. You can merge two items that are the same type.

Conclusion

In this blog post, we discussed the process of merging vendors in Quickbooks. By merging duplicate or similar vendor entries, you can streamline your accounting processes and ensure accurate record-keeping. Through the use of the Merge Vendors tool, you can select the vendors you want to merge and designate a primary vendor.

This consolidation helps eliminate any confusion or errors that may arise from having multiple vendor entries. By following the steps outlined in this post, you can easily merge vendors in Quickbooks and maintain a more organized and efficient accounting system.