Present value is one of the most important concepts in finance. It is used to discount future cash flows back to their present-day value. This allows investors to compare different investment opportunities and make decisions based on which option will provide the best return.

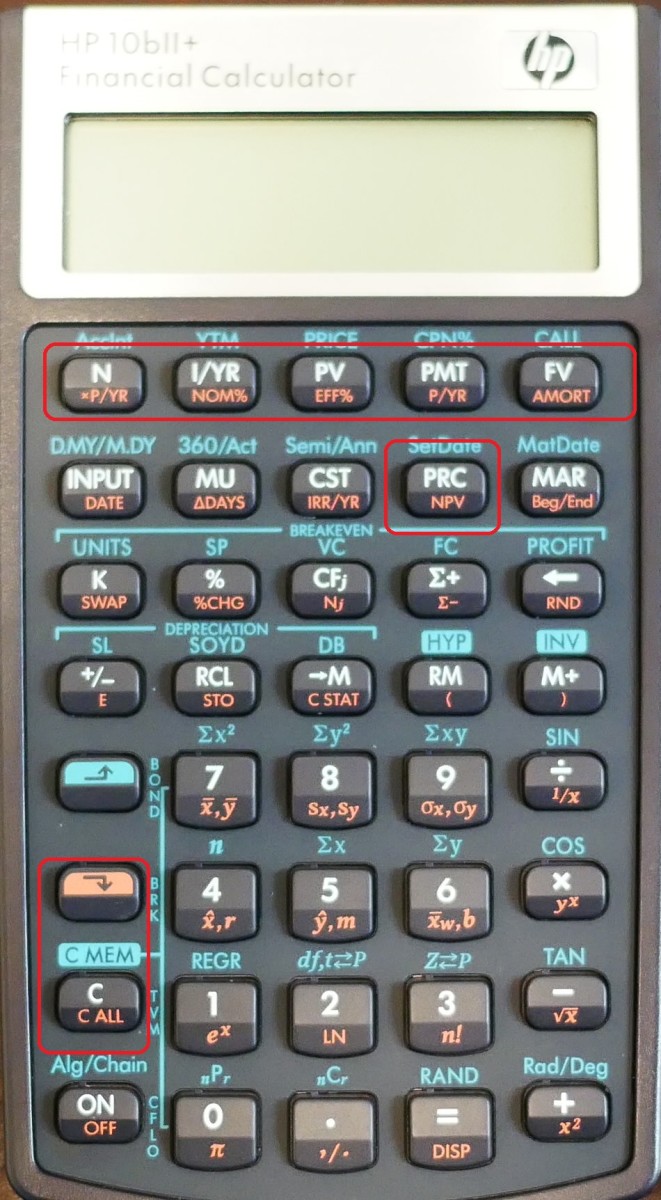

The HP 10bII+ financial calculator can be used to easily calculate present value.

- Enter the present value, or PV, into the calculator

- This is the lump sum that you currently have

- Enter the interest rate, or i%

- This is the percentage of interest that accrues on your PV each year

- Enter the number of years, or n, over which you plan to earn this interest

- Press “Calculate” to determine the future value, or FV, of your investment

- This is the amount of money that you will have at the end of n years if you do not withdraw any funds and allow your interest to compound annually

Credit: toughnickel.com

How Do You Calculate Present Value?

In order to calculate the present value of an investment, you need to discount the future cash flows by the required rate of return. The required rate of return is simply the minimum return that an investor requires in order for them to be willing to make an investment. There are a few different methods that can be used in order to calculate present value, but the most common and straightforward method is known as the time value of money.

This method discounts future cash flows back to their present value by using a certain interest rate or discount rate. The time value of money states that a dollar today is worth more than a dollar tomorrow because you can invest that dollar today and earn interest on it. In other words, money has a time value because it can earn interest.

The formula for calculating present value using the time value of money is: Present Value = Future Value / (1+r)^n Where r is the required rate of return (discount rate) and n is the number of periods until the future cash flow occurs.

For example, let’s say you have an investment that will pay you $100 one year from today. If your required rate of return is 10%, then the present value of this investment would be calculated as follows: Present Value = 100 / (1 + 0.10) ^ 1

How Does Hp 10Bii Calculate the Time Value of Money?

The HP 10bII is a financial calculator designed for business and finance students, professionals and investors. It can be used to calculate the time value of money (TVM) using the following steps: 1. Enter the present value (PV), future value (FV), interest rate (i), and the number of periods (n).

For example, if you want to find the TVM of $100 invested at 10% for 5 years, you would enter PV=100, FV=0, i=10%, n=5 into the calculator. 2. Press the TVM button. The answer should appear on the display as $146.41.

How Do You Calculate the Annuity Due on Hp 10Bii?

An annuity is a financial product that pays out a fixed stream of payments over a period of time. An annuity due is an annuity where the first payment is made immediately, as opposed to at the end of the period. The HP 10BII is a financial calculator that can be used to calculate annuities.

To calculate an annuity due on the HP 10BII, press the “fV” button and enter the following information: -The present value, which is the amount of money you have today that will be used to make future payments. This is typically your initial investment.

-The interest rate per period. This is the rate at which your money will grow over time. -The number of periods.

This is the number of payments you will make over the life of the annuity. -Whether or not payments are made at the beginning or end of each period. For an annuity due, this should be set to “1”.

-The payment amount. This is the amount you will pay each period. After entering this information, press “Enter” and then “Calc” to see the results.

How Do I Calculate My Mortgage on Hp 10Bii?

If you’re looking to calculate your mortgage on an HP 10BII, there are a few things you’ll need to know first. First, you’ll need to know the purchase price of the home, the down payment amount, the loan term, and the interest rate. With this information, you can plug it into the HP 10BII’s mortgage calculator function and get an estimate of your monthly payments.

To use the mortgage calculator function on the HP 10BII, press “2nd” then “finance.” This will bring up a menu of different financial functions. Select “6: Mortgage” from this menu.

Next, enter all of the required information – purchase price, down payment amount, loan term (in years), and interest rate. Once you have all of this entered in, press “compute.” The HP 10BII will then display your estimated monthly payment amount.

This is just an estimate though – your actual monthly payments may be slightly different depending on factors like taxes and insurance.

Present Value of a Lump Sum (Single Amount) | HP 10BII+ Financial Calculator

Hp 10Bii+ Financial Calculator Online

If you’re looking for a financial calculator that’s packed with features and easy to use, the HP 10bII+ is a great option. This versatile calculator can handle everything from basic math to complex financial calculations, and it even has a built-in USB port for transferring data to your computer. Plus, the large display makes it easy to see what you’re doing, and the ergonomic design is comfortable to hold.

The HP 10bII+ is ideal for students, professionals, or anyone who needs to do financial calculations on a regular basis. It’s also great for real estate agents, loan officers, and other business professionals. And because it’s so affordable, it’s a great value for the money.

So what are some of the key features of the HP 10bII+? First of all, it has over 280 functions, which means it can handle just about any type of calculation you need to do. It also has an automatic shut-off feature that conserves battery life, and there’s a low-battery indicator so you’ll never be caught without power when you need it most.

Another nice feature is the direct access keys that let you quickly access commonly used functions with just one touch. For example, there’s a key for calculating mortgage payments, another for figuring out the present value or future value annuities, and still another for amortization schedules. These keys save time by eliminating the need to scroll through menus or enter long function names; simply press the key and go!

And if you ever need help using any of the calculator’s functions, just press the? key and step-by-step instructions will appear onscreen. No more flipping through pages in a manual trying to figure things out!

So if you’re in the market for an affordable and feature-packed financial calculator, be sure to check out the HP 10bII+. It’ll make your life easier – guaranteed!

Hp 10Bii+ Financial Calculator Manual

The HP 10bII+ financial calculator is a great tool for anyone who needs to perform financial calculations. It offers a variety of features that make it easy to use, including an easy-to-read display and keyboard, one-touch keys for common functions, and a variety of built-in functions. The calculator also comes with a comprehensive manual that provides detailed instructions on how to use all of its features.

Uneven Cash Flow Calculator Hp 10Bii

If you’re like most small business owners, you probably don’t have a lot of extra cash on hand. That’s why it’s important to be aware of your options when it comes to financing your business. One option is an uneven cash flow calculator, which can help you even out your cash flow and make sure you have enough money to cover your expenses.

An uneven cash flow calculator can be a helpful tool for small business owners who need to finance their businesses. This type of calculator can help you determine how much money you need to keep on hand in order to cover your expenses and make sure your business remains operational. It’s important to understand your options when it comes to financing your business, and an uneven cash flow calculator can be a helpful tool in this process.

How to Calculate Npv on Financial Calculator

If you’re looking to calculate the NPV (net present value) of an investment, you can use a financial calculator to figure out the answer. Here’s a step-by-step guide on how to do it: First, enter the amount of money that you plan to invest into the calculator.

This is the PV, or present value, of your investment. Next, enter the expected rate of return for your investment. This is the i%, or interest rate, that you’ll be earning on your investment.

Then, enter the number of years that you expect to earn this return. This is the n, or number of years, in which you’ll be receiving payments from your investment. Finally, press the “NPV” button on your calculator and it will spit out the net present value of your investment!

Conclusion

Are you looking for a quick and easy way to calculate present value? If so, then the HP 10bII may be the calculator for you! This handy device can perform a variety of financial calculations, including present value.

To calculate the present value of the HP 10bII, first, enter the interest rate per period. Next, enter the number of periods over which the investment will grow. Finally, enter the future value of the investment.

The calculator will then display the present value of the investment. Keep in mind that the interest rate used in this calculation must be an annualized rate. This means that if you are using a monthly interest rate, you will need to multiply it by 12 before entering it into the calculator.

Similarly, if you are using a quarterly interest rate, you will need to multiply it by 4 before entering it into the calculator. The HP 10bII is a great tool for anyone who needs to perform financial calculations on a regular basis. With its easy-to-use interface and wide range of features, it is sure to make your life easier.