A turbocharger is an air compressor that increases the pressure or density of air supplied to an internal combustion engine. This gives each intake cycle of the engine more oxygen, letting it burn more fuel and do more work, thus increasing power. However, turbos come with a price tag – both in terms of initial cost and increased insurance premiums.

Turbo boost your pension with salary sacrifice and avoid National Insurance rate rises

If you’re looking to add a little bit of zip to your ride, you may be considering a turbocharger. But before you start shopping around, it’s important to know that this modification can have an impact on your car insurance rates.

While the exact amount will vary depending on your insurer and other factors, you can expect your premiums to go up by at least a few hundred dollars per year if you add a turbocharger to your car.

This is because turbocharged cars are generally considered to be more risky to insure than their non-turbo counterparts.

There are a few things you can do to offset the impact of a turbocharger on your insurance rates. First, make sure you shop around for quotes from multiple insurers before making a decision.

Second, consider increasing your deductible to lower your overall premium costs. And finally, be sure to keep any modifications like this one well-documented and reported to your insurer so that they can properly adjust your rates accordingly.

Turbo Vs Non Turbo Insurance

There are a few key differences between turbo and non-turbo insurance. The biggest difference is that turbo insurance covers the costs of repairs to your vehicle if it is damaged in an accident, while non-turbo insurance does not. This means that if you are in an accident and your car is totaled, you will be responsible for the cost of repairs yourself with non-turbo insurance.

Turbo insurance also typically has higher limits on liability coverage than non-turbo insurance, so it provides more protection in the event that you are sued after an accident.

Are Turbo Cars More Expensive to Insure

Turbo cars are more expensive to insure than non-turbocharged cars. The insurance companies view turbocharged cars as being more risky to insure, since they have the potential to go faster and be involved in more accidents. In addition, turbocharged cars often cost more to repair or replace if they are damaged in an accident.

How Much Does a Turbo Cost

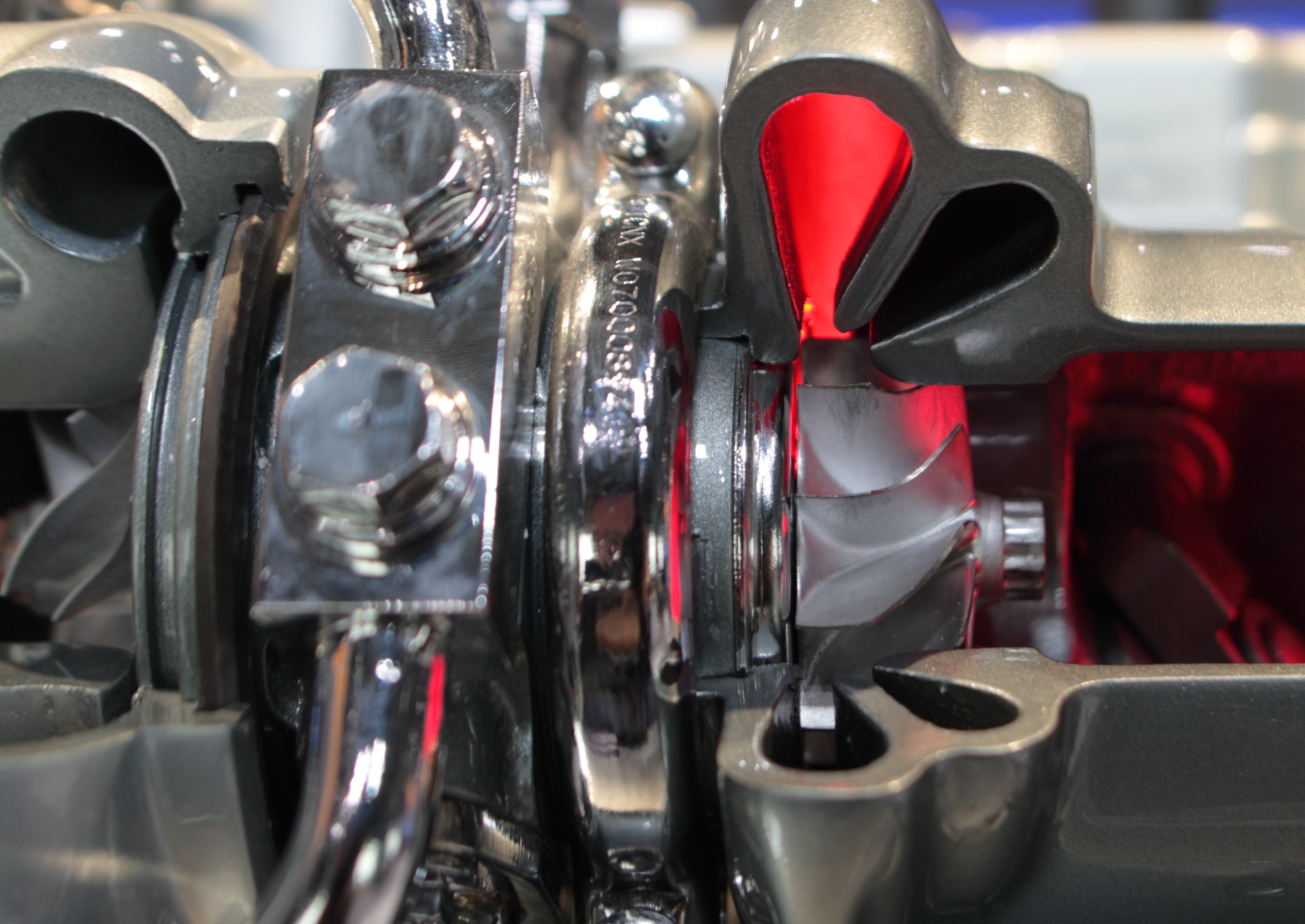

A turbocharger is an exhaust gas-driven compressor used to increase the power output of an internal-combustion engine by compressing air that is entering the engine thus increasing the amount of available oxygen. A key advantage of turbochargers is that they offer a considerable increase in power with only a slight increase in weight.

The cost of a turbocharger depends on several factors, including the type of car you have, the make and model of the turbocharger, and where you purchase it.

On average, turbochargers can range in price from $500 to $5,000.

How Much Does a Turbo Cost for a Car

If you’re looking to add a turbocharger to your car, you may be wondering how much it will cost. The answer isn’t necessarily simple, as there are several factors that can affect the price. Let’s take a look at some of the things that can impact the cost of adding a turbocharger to your car.

Type of Turbocharger

There are two main types of turbochargers: Garrett and Borg Warner. Garrett is the more popular option, and generally speaking, it will be less expensive than Borg Warner.

That said, Borg Warner does offer some advantages in terms of performance, so it’s worth considering if you’re serious about getting the most out of your turbocharged car.

Installation Costs

Installing a turbocharger is not a DIY job – it’s best left to a professional mechanic or engineer.

Installation costs will vary depending on who you hire and how complex the installation is (i.e., if your car needs other modifications to accommodate the turbocharger). Expect to pay anywhere from $500 to $2000 for installation, with higher-end installations costing closer to $5000.

Cost of Parts

Turbochargers themselves can range in cost from $1000 to $4000+, again depending on quality and brand. In addition to the actual turbocharger unit, you’ll also need an intercooler (which helps cool air coming from the turbo), piping, hoses, clamps, and various sensors and fittings – all told, plan on spending at least $1500 on parts alone.

Insurance for Car

There are many different types of insurance for cars, and it is important to understand what each type covers. The most common type of insurance is liability insurance, which covers damages that you may cause to another person or their property while driving. Other types of insurance include collision and comprehensive coverage, which cover damage to your own vehicle in the event of an accident or other incident.

There are also personal injury protection and medical payments coverage, which can help pay for your medical expenses if you are injured in an accident. It is important to talk to your insurance agent about all of the different options available so that you can choose the coverage that best meets your needs.

Credit: www.carwow.co.uk

Are Turbo Engines More Expensive to Insure?

Turbo engines have become increasingly popular in recent years as automakers strive to improve fuel economy and performance while reducing emissions. However, turbocharged engines generally cost more to insure than their non-turbo counterparts. Here’s a look at why that is and how it affects your car insurance rates.

Turbocharged engines use forced induction to compress air before it enters the combustion chamber. This allows for more efficient combustion, which results in more power and better fuel economy. While this technology has many benefits, it also comes with some added costs.

For one, turbocharged engines tend to be more expensive to repair or replace than non-turbocharged engines. That’s because the extra parts and complexity of a turbo system can drive up the price of repairs. Additionally, turbochargers are often located near other engine components that are susceptible to damage from heat or debris, so repairs can be even more costly.

Another factor that contributes to higher insurance rates for turbocharged cars is the increased risk of accidents. Studies have shown that drivers of turbocharged cars are more likely to be involved in an accident than those driving non-turbocharged cars. This is likely due to the fact that drivers of turbocharged cars often push their vehicles harder and take greater risks on the road.

Whether you’re driving a Turbo Charged Audi or a Mercedes Benz with a Turbo Charger System, you’re going to pay about 5%-20% higher premium for your car insurance coverage!

How Much Does a Turbocharger Increase Insurance?

Turbochargers can increase insurance rates by as much as 20 to 30 percent. This is because turbocharged engines are more powerful and thus pose a greater risk to insurers. In addition, turbochargers can also make it more difficult to get insurance coverage in some cases.

Does Having a Turbo Increase Insurance?

A turbocharger is an exhaust gas-driven compressor used to increase the power output of an internal-combustion engine by compressing air that is entering the engine thus increasing the amount of available oxygen. A key advantage of turbochargers is that they offer a considerable increase in power with only a slight increase in weight.

While this technology has been around for decades, only recently have carmakers begun to widely use turbochargers in passenger cars.

This trend was driven by stricter emissions regulations and the need for automakers to find ways to wring more power out of smaller engines. The result is that today, turbocharged engines are found in all sorts of vehicles, from economy cars to luxury SUVs.

One thing that hasn’t changed much over the years is the fact that insurance companies view turbocharged cars as being riskier to insure than their non-turbocharged counterparts.

There are a few reasons for this:

Turbocharged engines tend to be more powerful than non-turbocharged engines, which can make them more tempting for drivers who like to push their cars to the limit. And when drivers do get into accidents while driving these types of cars, repairs can be costly because they often involve specialised parts that aren’t always easy or cheap to replace.

Turbocharged engines also tend to have higher repair costs due general maintenance issues such as leaks and oil changes. These required upkeep tasks add another layer of expense onto already pricey repairs.

Because they’re designed to operate at high speeds and under high loads, turbochargers can also be prone to failure if not properly maintained.

Do You Have to Tell Your Insurance If You Turbo Your Car?

No, you do not have to tell your insurance if you turbo your car. However, if you are in an accident and the other driver sues you, your insurance company may not cover you if they find out that you had a turbo on your car.

Conclusion

A turbocharger is an exhaust gas-driven compressor used to increase the power output of an internal combustion engine by compressing air that is entering the engine thus increasing the amount of available oxygen. A key advantage of turbocharging is that it allows an engine to downsize while still maintaining or increasing its power output. This means that a smaller, more fuel-efficient engine can be used which ultimately results in lower insurance premiums.