Billable Expense Income in QuickBooks is the income recorded when a client pays for a billable expense included in an invoice. To record billable expenses in QuickBooks, you need to turn on billable expense tracking and set up the necessary settings.

Billable expenses are costs incurred on behalf of a client that will eventually be charged or passed on to the client. These expenses are typically incurred while providing goods or services to the client. In QuickBooks, you can categorize expenses and income to help organize your financial transactions effectively.

By following these steps, you can accurately track and record billable expenses in QuickBooks.

Credit: quickbooks.intuit.com

What Is Billable Expense Income?

In Quickbooks, billable expense income refers to expenses incurred on a client’s behalf and later charged to them. When creating an invoice, Quickbooks prompts to add the billable expense, and once paid, the amount becomes billable income. This feature streamlines tracking and invoicing for billable expenses in the accounting software.

Definition

Billable Expense Income in QuickBooks refers to the income generated when a business bills a client for expenses incurred on their behalf. When these expenses are included in an invoice and subsequently paid by the client, the amount is recorded as billable expense income.

Significance

Billable Expense Income plays a crucial role in accurately tracking and reporting revenue in QuickBooks. By recording billable expenses and associating them with specific customers, businesses can ensure proper reimbursement for expenses incurred during the provision of goods or services.

Credit: quickbooks.intuit.com

Managing Billable Expenses In Quickbooks

Efficiently manage billable expenses in QuickBooks by enabling billable expense tracking. Record expenses incurred for clients and easily invoice them once paid, categorizing as billable expense income for accurate financial tracking. Simplify client billing and streamline income reporting with QuickBooks’ user-friendly features.

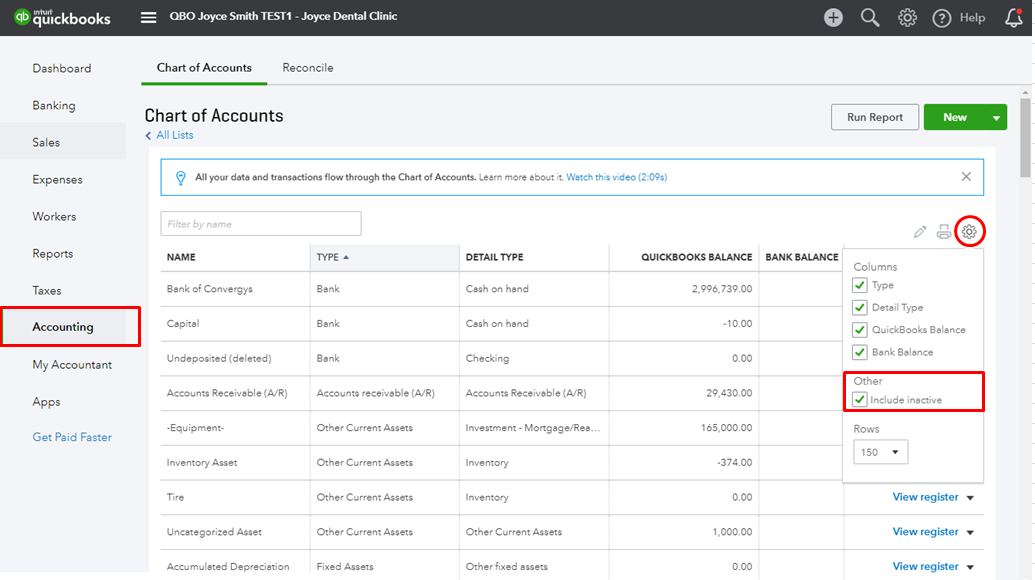

Turning On Billable Expense Tracking

To effectively manage billable expenses in QuickBooks, it’s essential to turn on billable expense tracking. This feature allows you to easily track and invoice expenses that are incurred on behalf of your clients. To turn on billable expense tracking in QuickBooks, follow these simple steps: – Go to Settings ⚙ on the QuickBooks dashboard and select Account and settings. – Navigate to the Expenses tab. – From the Bills and expenses section, click on Edit ✎. – Turn on the billable expense tracking option. – Optional: Set up additional preferences such as bill payment terms. – Lastly, click on Save to confirm your changes. Enabling billable expense tracking ensures that you can accurately record and invoice these expenses, streamlining your billing and saving you time in the long run.Categorizing Expenses And Income

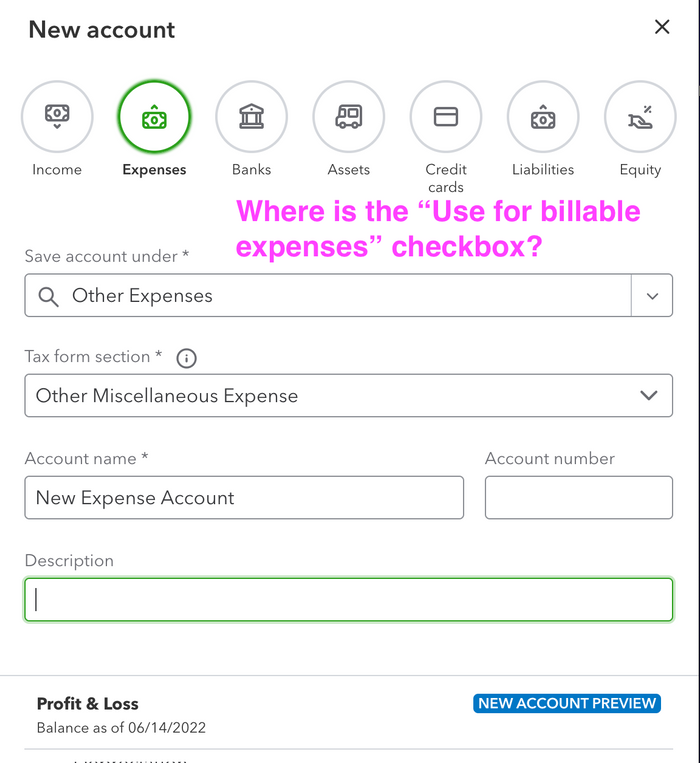

Properly categorizing billable expenses and income is crucial for maintaining a clear financial record and ensuring accurate billing. QuickBooks offers various options for categorizing expenses and income related to billable items. Here’s how you can categorize them effectively: 1. Expense Categories: Categorize billable expenses based on the nature of the expense, such as travel, supplies, or subcontractor costs. This categorization helps you easily identify and track different types of billable expenses. 2. Income Accounts: To track billable expenses’ income, QuickBooks provides an “Billable Expense Income” account. This income account allows you to record the amount your client pays for the billable expenses. By using standardized categories for expenses and income, you can easily generate reports and gain a deeper understanding of your billable expenses’ impact on your bottom line. In conclusion, effectively managing billable expenses in QuickBooks involves turning on billable expense tracking and categorizing expenses and income accurately. By following these steps, you can streamline your billing process and maintain a clear financial record, ultimately improving your overall financial management.Invoicing And Recording Billable Expenses

When using Quickbooks for billable expense income, you can easily track and record expenses that will be invoiced to your clients. Simply enable billable expense tracking in the settings and add the expenses to your invoice, resulting in accurate income recording.

Adding Billable Expenses To Invoices

When it comes to invoicing and recording billable expenses in QuickBooks, it’s crucial to understand how to add these expenses to your invoices. This ensures that you accurately track and bill your clients for any expenses incurred on their behalf. Adding billable expenses to invoices in QuickBooks is a straightforward process that can be done in just a few simple steps.

To add billable expenses to an invoice in QuickBooks, follow these steps:

- Open QuickBooks and go to the ‘Invoicing’ section.

- Select the client for whom you want to add billable expenses.

- Create a new invoice for the client.

- In the invoice details, you will find an ‘Add Billable Expenses’ option.

- Click on ‘Add Billable Expenses’ to open the list of expenses.

- Select the relevant expenses that you want to add to the invoice.

- Once you have selected all the billable expenses, click ‘Save’ to add them to the invoice.

By following these steps, you can easily add billable expenses to your invoices in QuickBooks. This ensures that you accurately capture and bill your clients for any expenses incurred on their behalf.

Recording Billable Expense Income

To record billable expense income in QuickBooks, you need to follow a few simple steps to ensure accurate financial tracking and reporting. By recording billable expense income correctly, you can easily track your business’s revenue and expenses related to billable expenses.

Here’s how you can record billable expense income in QuickBooks:

- Open QuickBooks and go to the ‘Income’ section.

- Select the ‘Billable Expense Income’ account.

- Create a new transaction, like a deposit or sales receipt.

- In the transaction details, specify the amount and description of the billable expense income.

- Link the transaction to the relevant client or customer for whom the expense was incurred.

- Save the transaction to record the billable expense income.

By following these steps, you can accurately record billable expense income in QuickBooks. This ensures that your financial reports reflect the revenue earned from billable expenses and helps you understand your business’s profitability and cash flow.

Credit: quickbooks.intuit.com

Examples And Guide For Billable Expense Income

When using Quickbooks, billable expense income refers to the amount charged to clients for expenses incurred on their behalf. This guide provides examples and instructions on how to record billable expenses in Quickbooks. Learn how to categorize expenses and invoice them to clients seamlessly.

Revenue Generation

Connection To Accounting

Understanding the

Billable expenses are costs that a business incurs on behalf of clients, which will be reimbursed by clients in the future. These expenses are billable, meaning they can be invoiced to the clients for reimbursement. Let’s delve into some examples and a guide on how to handle billable expense income efficiently in QuickBooks.

Table: Examples Of Billable Expenses And Income

| Expense Type | Amount |

|---|---|

| Travel expenses for client meeting | $500 |

| Materials purchased for a project | $300 |

| External consultant fees | $700 |

- Turn on billable expense tracking in QuickBooks settings.

- Set up bill payment terms for accurate billing.

- Record billable expenses incurred on behalf of clients.

- Create and send invoices with billable expenses included.

- Receive client payments for billable expenses and record them as income.

By following this guide and accurately tracking billable expenses in QuickBooks, businesses can streamline their invoicing process, enhance revenue generation, and maintain financial clarity in their accounting practices.

Best Practices For Handling Billable Expenses

When dealing with billable expenses in Quickbooks, it’s crucial to follow best practices to ensure accurate tracking and maximize customer satisfaction. By implementing efficient methods for tracking, verifying, and communicating billable expenses, businesses can streamline their invoicing processes and maintain transparent customer relationships.

Tracking And Verification

To accurately track and verify billable expenses, it’s essential to establish a systematic process for recording and categorizing expenses incurred on behalf of clients. Utilize Quickbooks’ billable expense feature to assign expenses to specific customers and ensure proper documentation. Regularly review and reconcile billable expenses to validate accuracy and prevent discrepancies.

Customer Communication

Effective communication with customers regarding billable expenses is paramount. Clearly outline billable expenses on invoices and provide detailed breakdowns to enhance transparency. Promptly address any inquiries or discrepancies related to billable expenses to foster trust and strengthen client relationships.

Frequently Asked Questions For Billable Expense Income Quickbooks

What Is A Billable Expense Income On Quickbooks?

In QuickBooks, billable expense income is the amount charged to clients for expenses incurred on their behalf.

How Do I Record Billable Expenses In Quickbooks?

To record billable expenses in QuickBooks, turn on billable expense tracking. Go to Settings, then Account and settings, Expenses tab, Bills and expenses section, and select Edit. Turn on billable expense tracking and set up bill payment terms. Select Save.

What Type Of Account Are Billable Expenses?

Billable expenses are costs incurred for clients, later billed to them. It is recorded as income when paid.

How Do I Categorize Expenses And Income In Quickbooks?

To categorize expenses and income in QuickBooks, go to the Transactions menu, select Business or Personal, review and change categories if needed, then save.

Conclusion

Understanding billable expense income in QuickBooks simplifies invoicing and income tracking processes for businesses. Properly categorizing and recording billable expenses is essential for accurate financial management. By following these guidelines, you can effectively utilize QuickBooks to streamline your accounting practices.